East African Scholars Journal of Economics, Business and Management

Abbreviated Key Title: East African Scholars J Econ Bus Manag

ISSN 2617-4464 (Print) | ISSN 2617-7269 (Online) |

Published By East African Scholars Publisher, Kenya

Volume-2 | Issue-8 | Aug-2019 |

Quick Response Code

Journal homepage:

http://www.easpublisher.com/easjebm/

Copyright © 2019 The Author(s): This is an open-

access article distributed under the terms of the

Creative Commons Attribution 4.0 International

License (CC BY-NC 4.0) which permits unrestricted

use, distribution, and reproduction in any medium

for non-commercial use provided the original

author and source are credited.

DOI: 10.36349/easjebm.2019.v02i08.011

Article History

Received: 18.07.2019

Accepted: 06.08.2019

Published: 20.08.2019

Published By East African Scholars Publisher, Kenya 452

Research Article

Awareness of Internet and Internet Banking in Indian Banks

Dr. Asha Singh

Assistant Professor, Department of Business Studies Princess Noora Bin Abdul Rahman University, Saudi Arabia

*Corresponding Author

Dr. Asha Singh

Abstract: The research paper describes the awareness and uses of internet and internet banking in Indian banks.

Particularly, it seeks to examine the current status of internet banking in Indian banks. Banking is a financial Institution

that handles cash, credit and other financial transactions. It is a safe place to store extra cash and credit. Various

developments have taken place in Indian banks. The biggest revolution came in Indian banks is digitization. Now day’s

new devices/technologies are providing several customer touch points. Customers touch a computer screen and

computers are providing information. Online transactions are done through internet banking. All the banks has used

internet banking services but adoption of this service is less in India. It includes customer awareness and time consuming

process. Online banking is also known as internet banking. It is an electronic payment system in which the customer

conducts transactions electronically via the internet. Internet technology will be the backbone of Indian Banking Industry

in future. Banking system can’t survive without internet technology. Day by day increasing change in technology, it leads

to e-banking services in various banks.

Keywords: Online banking, Indian banks, customer, computer, fund transfers, customers.

1. INTRODUCTION

Internet banking came in UK and USA in

1920s. It became prominently popular during 1960s

through electronic funds transfers and credit cards. The

concept of web-based banking came into existence in

Europe and USA in the beginning of 1980s. It has been

estimated that around 40 percent of banking transaction

would be done through internet. Internet banking is

very useful to those customers who have computer with

internet connection. Through online customer can get

various facilities like they can get full information about

their account, cheque book request etc.

Meaning of E-Banking:

E-Banking is the electronic bank that provides

the financial service for the individual client by means

of internet. Presently there are 30 private banks (21 old

and 9 new), 27 public sector banks and 36 foreign

banks operating in India. List of banks who are

providing internet banking such as State bank of India,

State bank of Mysore, State bank of Hyderabad, State

bank of Travancore, State bank of Bikaner and Jaipur,

Union Bank, Bank of India, Canara bank, Corporation

bank, City Union bank, Indian bank, Indian overseas

bank, HDFC bank, CITI bank, Indusind bank, Kotak

Mahindra bank, IDBI bank, Federal bank, Deutsche

bank, Yes bank, Bank of Maharashtra, Catholic Syrian

bank, Karur Vysya bank, DCB bank, Lakshmi vilas

bank, South Indian bank, Jammu and Kashmir bank,

Karnataka bank. Indian banks offer to their customers

following e-banking products and services: Automated

Teller Machine (ATMs), Internet Banking, Mobile

Banking, Telebanking, Electronic Clearing Services,

Electronic Clearing Cards, Smart Cards, Door step

Banking, Electronic Fund Transfer. According to a

recent survey conducted by the Federal Reserve, 71

percent of adults with bank accounts use online banking

services, and 38 percent access services via mobile

devices, an increase of five percent over the previous

year.

2. Literature Review

A large number of researchers have been

studied related to Internet Banking. A review of the

relevant literature has been described as under:

Asha Singh; East African Scholars J Econ Bus Manag; Vol-2, Iss-8 (Aug, 2019): 452-456

© East African Scholars Publisher, Kenya 453

England et al., (1998), Furstet al.,

(2000a,2000b,2002a and 2002b) found that banks in all

size categories offering internet banking were generally

more profitable and tended to rely less heavily on

traditional banking activities in comparison to non-

internet banks.

Prema C. (2013) examined the process of

Internet banking services and stresses that marketing

experts should emphasize these benefits and its

adoption provides and awareness can also be improved

to attract consumer’s attention to internet banking

services in her research article “Factors Influencing

Consumer Adoption of Internet Banking in India”.

Khalil and Pearson (2007) have found that

trust is the most important factor for accepting internet

banking facilities. To encourage Internet adoption,

banks need to develop strategies that improve the

customer’s trust in the underlying technology. The other

factors include quick response, customer control on

transaction (personalization), order tracking facilities

and privacy are other important in customers, making

customers feel safe in their transactions, employees who

are consistently courteous and employees who have the

knowledge to answer customer question.

Abou-Robich, Moutaz (2005) studied how to

analyse comfort levels and attitude of users towards

online banking facilities. The findings resulted that

there is a correlation between attitude towards e-

banking and feeling of security with regard to their

demographic variables.

Featherman, MauricioSanchez (2002) studied

that perceived risk inhibited consumer adoption

intentions as well as perception of the usability,

usefulness of online payment.

Statement of the problem:

Online banking provides a convenient method

of conducting bank business to customers from their

home and personal computer. Consumers can check

information regarding their account balances and

review it twenty four hours. This study is an attempt to

sketch the uses of internet and internet banking in India.

In the modern era, the activities of the Indian banks

have increased many folds and internet banking

customers have ability to perform online transactions.

Several Institutions are now providing free banking

services such as prepaid cards, pay-day loans, business

loans etc.

Objectives of the Research

To study several e-banking services adopted by

Indian banks.

To explain the different forms of online banking.

To understand the concept and uses of online

banking.

To study the importance and advantages of online

banking.

To understand the effect of online banking in the

performance of banks.

To evaluate the awareness of E-Banking among the

Indian banks.

RESEARCH METHODOLOGY:

This study has done to know the active internet

users and internet banking in India.

Data Collection Tools:

The study was based on secondary data.

Researcher has collected that data from the statista

portal and internet world stats. This was collected

during the year 2015-2018.

Analysis of Data: The collected data was made in

tabulated form and then analyzed.

In the Table 1 while China has got its internet

users to the extent of 751 million of its population.

India has its internet users to the extent of 462 million

of its population. Thus India is the 2

nd

highest user of

internet in the world.

Table1. Number of internet users in the Asia Pacific

region as of January 2018, by country

Source: Statista: The statistics Portal

Country Internet Users(million)

China 751

India 462

Indonesia 132.7

Japan 118.5

Bangladesh 81.7

Philippines 67

Vietnam 64

Thailand 57

South Korea 47.35

Pakistan 44.6

Malaysia 25.08

Australia 21.74

Taiwan 20.84

Nepal 16.19

Mynamar 18

Sri Lanka 6.71

Hong Kong 6.46

Singapore 4.83

New Zealand 4.18

Papua New Guinea 0.91

Fiji 0.5

Timor-Leste 0.41

Maldives 0.34

North Korea 0.02

Asha Singh; East African Scholars J Econ Bus Manag; Vol-2, Iss-8 (Aug, 2019): 452-456

© East African Scholars Publisher, Kenya 454

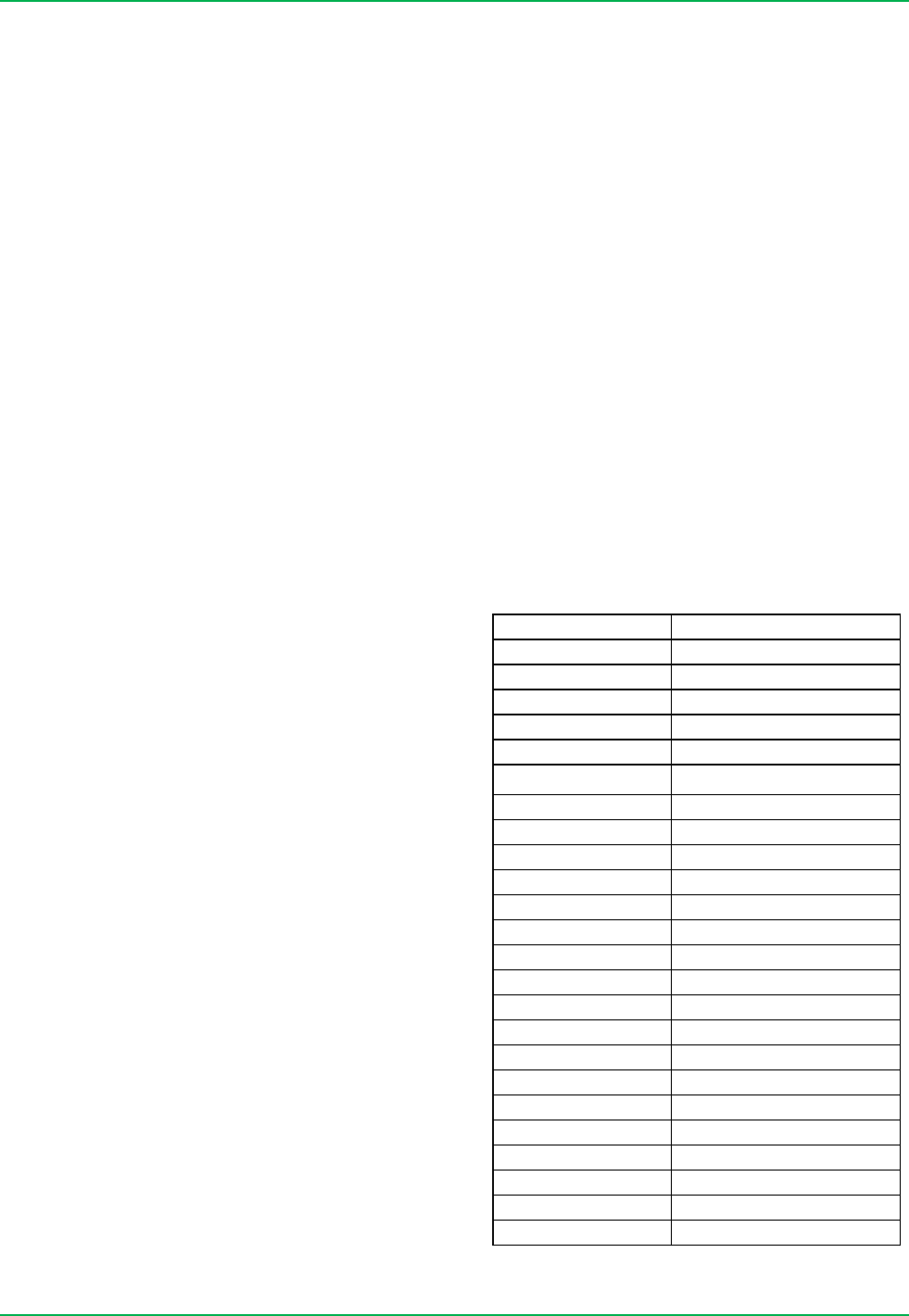

Table2. Countries with the biggest share of internet

users in Asia as of June 2018

If we look over the statistics in Table 2 while

China has got its internet users to the extent of 38.9% of

its population. India has its internet users to the extent

of 22.4%of its population of 126.7 crores (in 2016) as

on 6/2018. Thus India is the 2

nd

highest user of internet

in the world.

Now internet in India has become sources of

studying, reading but sources obtaining various

knowledge for our youth generation.

Fig.1. Percentage (%) internet users in Asia

If we see the Figure 1 China has the got the highest

internet users and India is the 2

nd

highest user of

internet in the world. The report found that 97% of

users use mobile phones as one of the devices to access

internet. 87% or 493 million Indians are regular users.

In Urban area there are approximate 293 million

internet users and 200 million in rural areas.

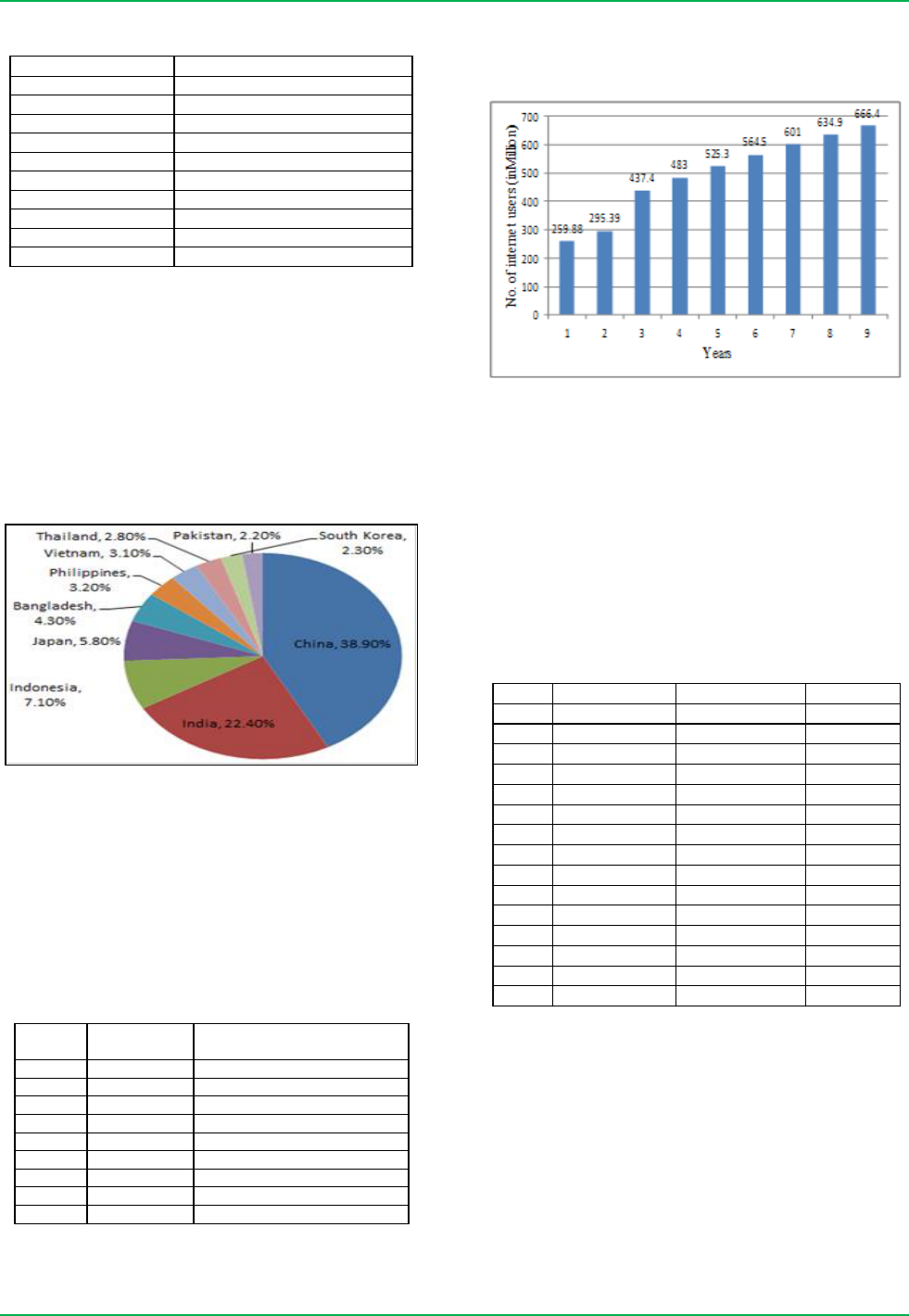

Table3. Number of internet users in India from 2015

to 2023

Source: Statista: The statistics Portal

From the Table 3 we see that there is a rapid

growth of internet users . It is assumed that number of

internet users in 2020 will be 564.5 million, in 2021

increase by 601 million, in 2022 increase by 634.9

million and in 2023 increse by 666.4 million.

Fig.2. No. of internet users (in Million)

The figure 2 shows that the growth of internet

users took faster turn and went on increasing with much

faster pace of like advanced countries. If we now look

over the statistics in Table 3 the number of users is

259.88 in 2015, 295.39 in 2016, 437.4 in 2017, 483 in

2018, 525.3 in 2019, 564.5 in 2020, 601 in 2021, 634.9

in 2022 and 666.4 in 2023.With such tremendous

growth, India has now become the most popular users

of internet usage.

Table4. Internet usage and Population Statistics of

India

Source: Internet World Stats (Usage and population

statistics)

Statistics contained in Table 4 indicates that

India entered into internet usage with just 0.1% of its

population in 1998. Since then the number of internet

users in India started increasing slowly although the

population remained constant up to 2004 but number of

users speeded up and took faster turn/jump from 7%in

2009, 8.5% in 2010, 11.4% in 2012, 30%in 2015 and

36.5% in 2016. Indeed the bumper jumps from 2015

onwards are broadly due to the popular contribution of

banking sector. Thereafter, the growth in number of

Country Percentage (%)

China 38.90%

India 22.40%

Indonesia 7.10%

Japan 5.80%

Bangladesh 4.30%

Philippines 3.20%

Vietnam 3.10%

Thailand 2.80%

South Korea 2.30%

Pakistan 2.20%

S. No.

Year

No. of internet

users (in millions)

1

2015 259.88

2

2016 295.39

3

2017 437.4

4

2018 483

5

2019 525.3

6

2020 564.5

7

2021 601

8

2022 634.9

9

2023 666.4

Year Users Population Percentage

1998 1,400,000 1,094,870.68 0.10%

1999 2,800,000 1,094,870.68 0.30%

2000 5,500,000 1,094,870.68 0.50%

2001 7,000,000 1,094,870.68 0.70%

2002 16,500,000 1,094,870.68 1.60%

2003 22,500,000 1,094,870.68 2.10%

2004 39,200,000 1,094,870.68 3.60%

2005 50,600,000 1,112,225,812 4.50%

2006 40,000,000 1,112,225,812 3.60%

2007 42,000,000 1,129,667,528 3.70%

2009 81,000,000 1,156,897,766 7.00%

2010 100,000,000 1,173,108,018 8.50%

2012 137,000,000 1,205,073,612 11.40%

2015 375,000,000 1,251,695,584 30.00%

2016 462,124,989 1,266,883,598 36.50%

Asha Singh; East African Scholars J Econ Bus Manag; Vol-2, Iss-8 (Aug, 2019): 452-456

© East African Scholars Publisher, Kenya 455

users took faster turn and went on increasing with much

faster pace of alike advanced countries. India has now

become the most popular users of internet usage.

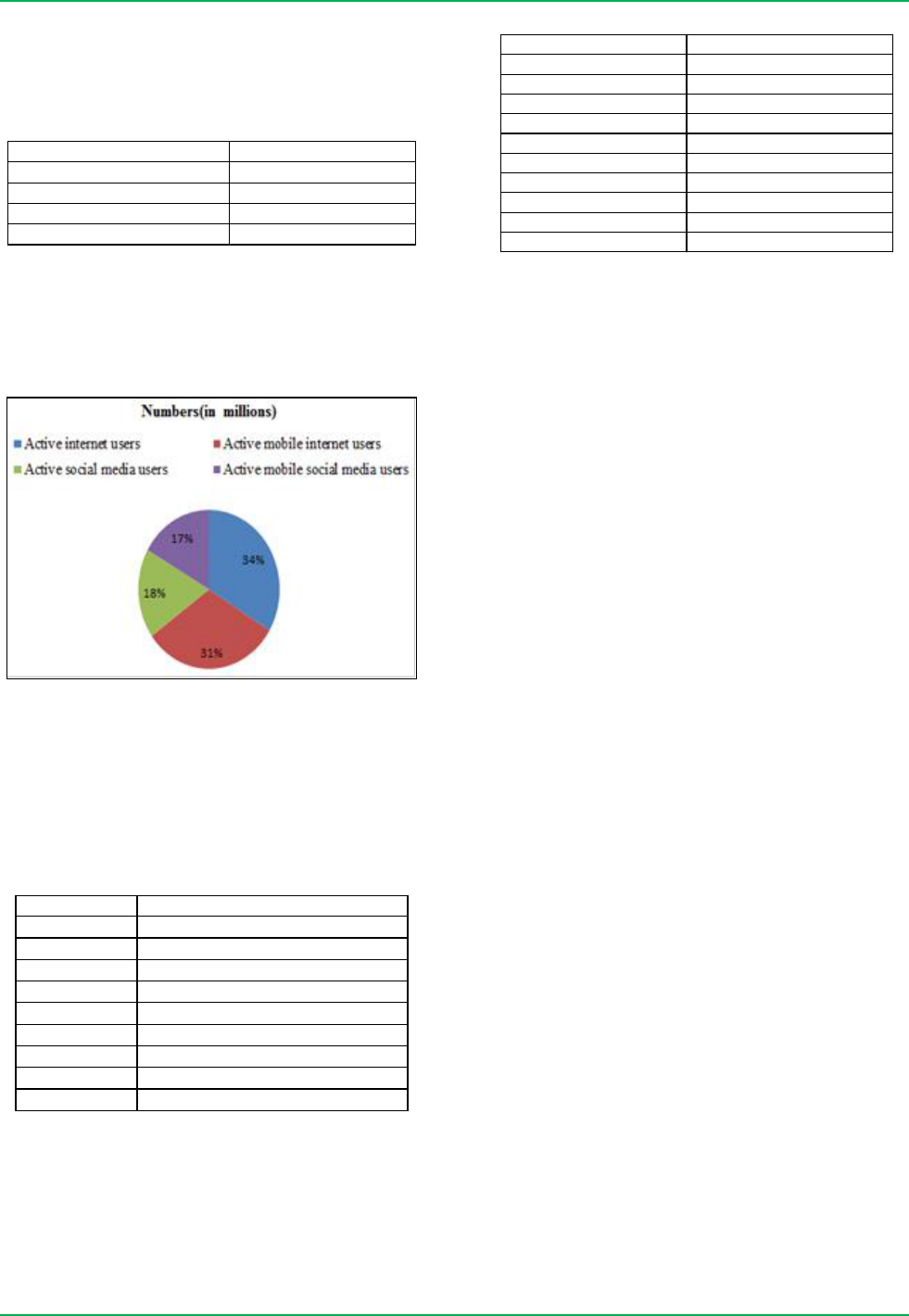

Table5. Digital Population in India as of January

2018

Source: Statista: The statistics Portal

From the table 5, we see that the number of active inter

users are 462 million, Active mobile internet users are

430.3 million, active social media users are 250 million

and active mobile social media users are 230 million.

Fig.3. Numbers of users (in millions)

The Figure 3 shows that there are many

internet users in India. The percentage of number of

active internet users are 34%, active mobile internet

users are 31%, active social media users are 18% and

active mobile social media users are 17%.

Table6. Number of Face book users in India from

2015 to 2023

Source: Statista: The statistics Portal

From the table 6, we see that the number of

Face book users 135.6 in 2015, 165.57 in 2016, 248.3 in

2017, 281 in 2018, 313.6 in 2019, 346.2 in2020, 378.9

in 2021, 411.5 in 2022 and 444.2 in 2023. We see that

numbers of facebook users are also increasing day by

day.

Table7. Top Indian banks with their rating points

Source: Rating on Google Play Store

RESULTS

In the present competitive era, while the entire

world is trying to do their best and have the respectful

position in the field of info technology and India has

now become one of the largest broadcasting networks in

terms of infrastructure. The above banks have the

highest number of internet banking under their names

and are rendering excellent service in the Indian

Banking Sector. The customers have more choices in

choosing their banks. There is a competition within

Indian Banks. Indian banking is known as World’s best

banking but we can’t say which bank provides best

services because nobody will satisfy with a single bank.

According to table 7, the rating point of Axis Bank is

top in internet banking. Its rating is 4.26 out of 5.It

shows people are using more internets banking in Axis

Bank. In the present study for Indian internet banking

we have taken ten banks.

3. Facilities available under Internet banking in

India

Bill payment service: Through internet banking.

We can pay electricity bill, gas bill, water bill, LIC

policy etc.

Fund transfer: We can transfer our money from

one bank account to other account either within a

single financial institution or across multiple

institutions by using many mobile apps like pay

pal, venom, Google wallet, Square cash, Payme,

bhim etc. without the direct intervention of bank

staff.

Credit card customers: A credit card is a card,

signed by a cardholder that grants a permission to

charge their card for a limited period of time as

mentioned on card.

Railway pass and online booking: we can take out

railway pass and book railway ticket, flight ticket,

bus ticket etc. through online banking.

Investing through internet banking: Monitor

investment policy through online then invest on

mutual funds, share markets etc.

Recharging prepaid phones: Prepaid bill is the

leading website for easy mobile recharges online.

The best way to recharge your prepaid service is

through Express Recharge or My Vodafone.

Shopping at fingertips: Now a day’s life is very

busy and no one has time to go outside for

Internet Users Numbers(in millions)

Active internet users 462

Active mobile internet users 430.3

Active social media users 250

Active mobile social media

230

Year Numbers(in Million)

2015 135.6

2016 165.57

2017 248.3

2018 281

2019 313.6

2020 346.2

2021 378.9

2022 411.5

2023 444.2

Bank Name Rating Points (out of 5)

Axis Bank 4.26

Corporation Bank 4.14

Allahabad Bank 4.08

Bank of Baroda 4.07

HDFC Bank 4.06

Oriental Bank of

4.04

Central Bank of India 4.03

Indian Bank 4.03

Union Bank of India 4.02

Canara Bank 3.98

Asha Singh; East African Scholars J Econ Bus Manag; Vol-2, Iss-8 (Aug, 2019): 452-456

© East African Scholars Publisher, Kenya 456

everything so through online banking we can order

any quality product at lowest prices.

4. Merits of Internet Banking

There are many merits of internet banking given below:

It is more convenient;

Customer can do it from home;

Its charges are very nominal;

Cash back and other rewards;

It emphasis on mobile and online banking;

No age limit is needed for internet banking;

It provides customer satisfaction by exchanging the

product;

It simplifies the choice of the customer;

Money credited in account in case of any defective

product or cancellation of ticket;

It saves time.

5. Demerits of internet Banking

There are many demerits of internet banking given

below:

Chances of fraud increases;

Internet connection is must;

For deposit or cash withdrawal we have to go to

bank.

6. CONCLUSION

Banking in India has rapidly innovated to keep

up with the times. The internet banking has a great

impact on the Indian banking system. To define and co-

ordinate banking technology, RBI (Reserve bank of

India) set up a number of committees. Indian banks are

rapidly progressing due to digital transformation in

banking and it has two sides – the positive and the

negative side. The internet banking offers many

transactions and inquiries to be performed online

without visiting the branch but chances of fraud has

increased. Innovations like cash transfers, bill payment

of gas, electricity etc. through mobile phones and online

banking customers are satisfied. ATMs facility for easy

withdrawals and payments, Passbook entries has been

replaced by hassle-free e- statement. The most

important thing is that banks have been able to ensure

that all these transactions are safe and secure. Apart

from these technologies, there are many other

technologies which Indian banks will adopt in future.

Now internet banking has become the necessity of

customers.

REFERENCES:

1. Abou-Robieh, M. (2005). “A study of e-banking

security perceptions and customer satisfaction

issues.

2. Featherman, M.S.”(2007), Evaluative criteria and

user acceptance of Internet based financial

transaction processing systems.

3. Khalil., & Pearson. (2007). The Influence of Trust

on Internet Banking Acceptance, Journal of

Internet Banking and Commerce, August 2007,

12(2).

4. Prema, C. (2013). Factore Influencing Consumer

Adoption of Internet Banking in India, Karunya

School of Management, Karunya University,

Coimbatore, India.

5. Pooja, M., & Balwinder, S. (2009). Impact of

Internet Banking on Bank Performance and Risk:

The Indian experience, Eurasian Journal of

Business and Economics, 2(4), pg.43-62.

6. Rangsan, N., & Titida, Nochai (2013). The impact

of Internet banking services on customer

satisfaction in Thailand: A case study in Bangkok,

International Journal of Humanities and

Management sciences (IJHMS), 1(1).

7. Roshan, L., & Rajni, S. (2012). E-Banking: The

Indian scenario, Asia Pacific Journal of Marketing

and Management Review, 1(4).

8. Shilpan, V. et al, (). Impact of E-Banking on

Traditional Banking services, International Journal

of Computer Science and Communication

Networks, 2(3), 310-313.

9. Vimla, V. (2015). the impact of Information

Technology Adoption on the customers of bank of

India, Banglore Urban-An Evaluative Study, IOSR

Journal of Business and Management (IOSR-JBM),

17 (13), pg.39-44.

https://www.investopedia.com

https://www:quora.com

https://www:valuepenguin.com

https://in:reuters.com

https://www.statista.com