POLICY ON CUSTOMER PROTECTION

– LIMITING LIABILITY

Reviewed vide DBR/CRD/S-279/2023-24 dated 21.02.2024

Customer Relations Department

The South Indian Bank Ltd

Head Office, Thrissur

TABLE OF CONTENTS

Sl. No Page No

1. Introduction 3

2. Objective 3

3. Scope 3

4. Applicability 3

5. Definitions and Explanation 4

6. Points covered under Policy 4

7. Third Party Breach 6

8. Roles and Responsibilities of the Bank 6

9. Rights and Obligation of the Customer 7

10. Notifying the bank on unauthorized transactions 8

11. Proof of Customer Liability 8

12. Redressal of Complaints / Grievance 8

13. Force Majeure 9

Annexure 10

1. Introduction:

South Indian Bank is committed to provide superior and safe customer service experience to all its

customers. Bank has over the years invested in technology and has robust security systems and

fraud detection and prevention mechanisms in place to ensure safe and secure banking experience

to its customers. As entailed in the Citizen’s charter, Bank already has in place policies such as

Comprehensive Deposit Policy, Customer Rights Policy and Customer Compensation policy.

Keeping in mind the increasing thrust on financial inclusion & customer protection, the Reserve

Bank of India had issued a circular on Customer Protection – Limiting Liability of Customers in

Unauthorized Electronic Banking Transactions. (RBI / 2017 – 18 / 15 DBR. No. Leg. BC. 78 /

09.07.005 /2017 - 18 dated July 6, 2017) which inter-alia requires Banks to formulate a Board

approved policy in regard to customer protection and compensation in case of unauthorized

electronic banking transactions

2. Objective:

This policy seeks to communicate in a fair and transparent manner the Bank’s policy on:

Customer protection (including mechanism of creating customer awareness on the risks and

responsibilities involved in electronic banking transactions),

Customer liability in cases of unauthorized electronic banking transactions

Customer compensation due to unauthorized electronic banking transactions (within defined

timelines)

3. Scope:

Electronic banking transactions usually cover transactions through the below modes:

Remote/ online payment transactions (transactions that do not require physical payment

instruments to be presented at the point of transactions e.g. internet banking, mobile banking,

card not present (CNP) transactions, Pre-paid Payment Instruments (PPI), etc.)

Face-to-face / proximity payment transactions (transactions which require the physical

payment instrument such as a card or mobile phone to be present at the point of transaction e.g

ATM, POS, etc.)

Any other electronic mode of credit effected from one entity to another currently being used

or adopted from time to time

This policy covers transactions only through the above modes. It excludes electronic banking

transactions effected on account of error by a customer (e.g. NEFT carried out to an incorrect

payee or for an incorrect amount), transactions done under duress, claims due to opportunity loss,

reputation loss, other incidental costs or collateral damage.

4. Applicability:

A. This policy is applicable to entities that hold relationship with the bank viz.:

Individual and non-individual customers who hold current or savings account or credit

facilities.

Individual / non-individual entities that hold credit card and/or prepaid card.

Individual / non-individual entities that use other electronic platforms of the Bank like internet

banking, mobile banking and e-wallet.

B. This policy is not applicable to:

Non-Customer that use Bank’s infrastructure e.g. ATMs, electronic e-wallet

Entities that are part of the ecosystem such as Interchange Organizations, Franchises,

Intermediaries, Agencies, Service partners, Vendors, Merchants etc.

5. Definitions & Explanations: (for the purpose of this policy)

Real loss is defined as financial outgo from customer’s account e.g. debit to customer’s account

or card.

Card not present (CNP) transactions are defined as transactions that require use of Card

information without card being physically used e.g. e-commerce transactions.

Card present (CP) transactions are defined as transactions that require use of physical card e.g.

at ATM or shops (POS)

Payment transactions are defined as transactions that involve transfer of funds from one

account/ e-wallet to another electronically and do not require card information e.g. NEFT.

Unauthorized transaction is defined as debit to customer’s account without customer’s consent

Consent includes authorization of a transaction debit either through standing instructions, as

per accepted banking practice and regulation, based on account opening process and related

matters or based on additional authentication required by the bank such as use of security

passwords, input of dynamic password (OTP) or static VBV/ MCSC, challenge questions or

use of Card details (CVV/ Expiry date) or any other electronic authentication option provided

by the Bank.

Date & time of reporting is defined as date & time on which customer has submitted a unique

complaint. Date of receiving communication from the Bank, is excluded for purpose of

computing number of working days for all action specified in this policy. The working

schedule of the home branch would be considered for calculating working days for customer

reporting. Time of reporting will be as per Indian Standard Time.

Notification means an act of the customer reporting unauthorized electronic banking

transaction to the bank

Number of days will be computed based on working days of the parent branch.

Mode of reporting will be the channel through which customer complaint is received first time

by the Bank, independent of multiple reporting of the same unauthorized transaction.

Loss in foreign currency if any shall be converted to Indian currency for the purpose of this

policy as per bank’s policies on conversion at card rate net of commission.

6. Points covered under the policy:

Customer shall be compensated in line with this policy in case of loss occurring due to

unauthorized transaction as follows:

A. Zero Liability of customer

Customer shall be entitled to full compensation of real loss in the event of contributory fraud/

negligence/ deficiency on the part of the bank (irrespective of whether or not the transaction is

reported by the customer).

Customer has Zero Liability in all cases of third party breach where the deficiency lies neither

with the bank nor with the customer but lies elsewhere in the system and the customer notifies

the bank within three working days of receiving the communication from the bank regarding

the unauthorized transaction.

B. Limited Liability of customer

Liability in case of financial losses due to unauthorized electronic transactions where

responsibility for such transaction lies neither with the bank nor with the customer, but lies

elsewhere in the system and there is a delay on the part of customer in notifying/reporting to

the Bank beyond 3 working days and less than or equal to 7 working days (after receiving the

intimation from the Bank).The liability of the customer per transaction shall be limited to

transaction value or amounts mentioned in Annexure -1 whichever is lower.

C. Complete Liability of customer

Customer shall bear the entire loss in cases where the loss is due to negligence by the customer,

e.g. where the customer has shared payment credentials or Account/Transaction details, viz.

Internet Banking user Id & PIN, Debit/Credit Card PIN/OTP or due to improper protection on

customer devices like mobile / laptop/ desktop leading to malware / Trojan or Phishing /

Vishing attack. This could also be due to SIM duplication by the fraudster. Under such

situations, the customer will bear the entire loss until the customer reports unauthorized

transaction to the bank. Any loss occurring after reporting of unauthorized transaction shall be

borne by the bank.

In cases where the responsibility for unauthorized electronic banking transaction lies neither

with the Bank nor with the customer, but lies elsewhere in the system and when there is a delay

on the part of the customer in reporting to the Bank beyond 7 working days, the customer

would be completely liable for all such transactions.

D. Other Points

In cases of zero / limited liability, the Bank shall credit (shadow reversal) the amount involved

in the unauthorised electronic transaction to the customer’s account within 10 working days

from the date of such notification by the customer (without waiting for settlement of insurance

claim, if any).In cases where prima facia, customer negligence is evident or in cases of

complete liability of customer, no shadow credit will be provided. If the investigation proves

negligence in cases where shadow credit is already given, the amount will be reversed.

Customer will be given 50 days’ time from date of reporting to submit documents for

consideration of the complaint.

Within 90 days of date of receipt of complaint, the Bank shall either establish customer

negligence or provide final credit to customer. Customer will be given value dated credit

(based on date of unauthorized transaction) when customer becomes eligible to be

compensated. In case of debit card/ bank account, the customer shall not suffer loss of interest

and in case of credit card; customer shall not bear any additional burden of interest for such

credit.

The Bank may, at its discretion, agree to credit the customer even in case of an established

negligence by the customer.

Customer would not be entitled to compensation of loss if any, in case customer does not agree

to get the card hot listed or does not cooperate with the Bank by providing necessary documents

including but not limited to police complaint and cardholder dispute form.

Compensation would be limited to real loss after deduction of reversals or recoveries received

by the customer.

7. Third Party Breach

The following would be considered as Third party breach where deficiency lies neither with the

Bank nor customer but elsewhere in the system:

Application frauds

Account takeover

Skimming / cloning

External frauds / compromise of other systems, for e.g. ATMs / mail servers etc. being

compromised

8. Roles & Responsibilities of the Bank:

The Bank shall ensure that the Customer protection policy is available on the Bank’s website

as well as at Bank’s branches for the reference by customers. The Bank shall also ensure that

existing customers are individually informed about the bank’s policy.

The Bank will regularly conduct awareness on carrying out safe electronic banking

transactions to its customers and staff. Information of Safe Banking practices will be made

available through campaigns on any or all of the following - website, emails, ATMs, phone

banking, net banking, mobile banking. Such information will include rights and obligation of

the customers such as non-disclosure of sensitive information. e.g. password, PIN, OTP, date

of birth, etc.

The Bank shall communicate to its customers to mandatorily register for SMS alerts. The Bank

will send SMS alerts to all valid registered mobile number for all debit electronic banking

transactions. The Bank may also send alert by email where email Id has been registered with

the Bank.

The Bank will enable various modes for reporting of unauthorized transaction by customers.

These may include SMS, email, website, toll free number, IVR, Phone Banking or through its

branches. The Bank will also enable specific space on its home page where customers can

report unauthorized electronic banking transaction

The Bank shall respond to customer’s notification of unauthorized electronic banking

transaction with acknowledgement. On receipt of customer’s notification, the Bank will take

immediate steps to prevent further unauthorized electronic banking transactions in the account

or card.

The Bank shall ensure that all such complaints are resolved and liability of customer if any,

established within a maximum of 90 days from the date of receipt of complaint, failing which,

bank would pay compensation as described in Annexure 1.

During investigation, in case it is detected that the customer has falsely claimed or disputed a

valid transactions, the bank reserves its right to take due preventive action of the same

including closing the account or blocking card limits

The Bank may restrict customer from conducting electronic banking transaction including

ATM transaction in case of non-availability of customer’s mobile number.

This policy should be read in conjunction with Grievance Redressal Policy of the Bank.

Clauses from the Bank’s Grievance Redressal Policy shall form a part of this policy where not

specifically addressed in this policy. The policy is available on Bank's Web-site.

9. Rights & Obligations of the Customer

A. Customer is entitled to

SMS alerts on valid registered mobile number for all financial electronic debit transactions.

Email alerts where valid email Id is registered for alerts with the Bank

Register complaint through multiple modes – as specified in point relating to Bank’s roles &

responsibilities

Intimation at valid registered email/ mobile number with complaint number and date & time

of complaint

Receive compensation in line with this policy document wherever applicable. This would

include getting shadow credit within 10 working days from reporting date and final credit

within 90 days of reporting date subject to customer fulfilling obligations detailed herein and

with customer liability being limited as specified in Annexure-I

B. Customer is bound by following obligations with respect to banking activities:

Customer shall mandatorily register valid mobile number with the Bank.

Customer shall regularly update his /her registered contact details as soon as such details are

changed. Bank will only reach out to customer at the last known email/ mobile number. Any

failure of customer to update the Bank with changes shall be considered as customer

negligence. Any unauthorized transaction arising out of this delay shall be treated as

customer’s liability.

Customer should provide all necessary documentation – customer dispute form, proof of

transaction success/ failure and should also file a police complaint and provide copy of the

same to the Bank.

Customer should co-operate with the Bank’s investigating authorities and provide all

assistance.

Customer must not share sensitive information (such as Debit/Credit Card details & PIN, CVV,

Net Banking Id & password, OTP, transaction PIN, challenge questions) with any entity,

including bank staff.

Customer must protect his/her device as per best practices specified on the Bank’s website,

including updating of latest antivirus software on the device (Device includes smart phone,

feature phone, laptop, desktop, tab or any other devices used for accessing the banks electronic

facilities.)

Customer shall go through various instructions and awareness communication sent by the bank

on secured banking available at banks website.

Customer must set transaction limits to ensure minimized exposure.

Customer shall abide by the tips and safeguards on Secured Banking available at Bank’s

website.

Customer must verify transaction details from time to time in his/her bank statement and/or

credit card statement and raise query with the bank as soon as possible in case of any mismatch.

10. Notifying the Bank of the unauthorized transaction:

Customer shall report unauthorized transaction to the Bank at the earliest, with basic details

such as Account Number and/ or Card number (last 6 digits), date & time of transaction and

amount of transaction

Customer shall follow bank’s reporting process viz.

Notify/ report through the options listed in the section on Roles & responsibilities of Bank

(8 d).

Lodge police complaint and maintain copy of the same and furnish police complaint when

sought by bank’s authorized personnel.

Customer shall authorize the bank to block the credit/ debit card/ net banking/ mobile banking

/ UPI / other channels of transaction in the account(s) to reduce likelihood of additional loss.

Customer to clearly specify the facilities to be blocked failing which, the Bank reserves the

right to block all electronic transactions of the customer to protect his/her interest.

Customer shall share relevant documents as needed for investigation or insurance claim viz.

cardholder dispute form, copy of passport in case of international transactions and police

complaint.

Fully co-operate and comply with Bank’s reasonable requirements towards investigation and

provide details of transaction, customer presence, etc.

For unauthorised transactions using Onecard, customer shall block the disputed card in the

Onecard mobile application or through Bank’s Customer Care or by mailing the details to

11. Proof of customer liability:

The Bank has a process of second factor authentication for electronic transactions, as regulated by

the Reserve Bank of India. Bank has onus to prove that all logs / proofs / reports for confirming

two factor authentication is available. Any unauthorized electronic banking transaction which has

been processed post second factor authentication known only to the customer would be considered

as sufficient proof of customer’s involvement / consent in effecting the transaction.

12. Redressal of Complaints / Grievance:

For any complaint / grievance with regard to services rendered by the Bank, customer has a right

to approach authority (ies) designated by the Bank for handling customer complaint/ grievances.

They will be dealt in accordance with bank’s Policy on Grievance Redressal. The details of the

internal set up for redressal of complaints/ grievances will be displayed in the branch premises.

The branch officials shall provide all required information regarding procedure for lodging the

complaint. The same is also available in Bank’s Website.

13. Force Majeure:

The bank shall not be liable to compensate customers for delayed credit if some unforeseen event

(including but not limited to civil commotion, sabotage, lockout, strike or other labour

disturbances, accident, fires, natural disasters or other “Acts of God”, war, damage to the bank’s

facilities or of its correspondent bank(s), absence of the usual means of communication or all types

of transportation, etc. beyond the control of the bank prevents it from performing its obligations

within the specified service delivery parameters.

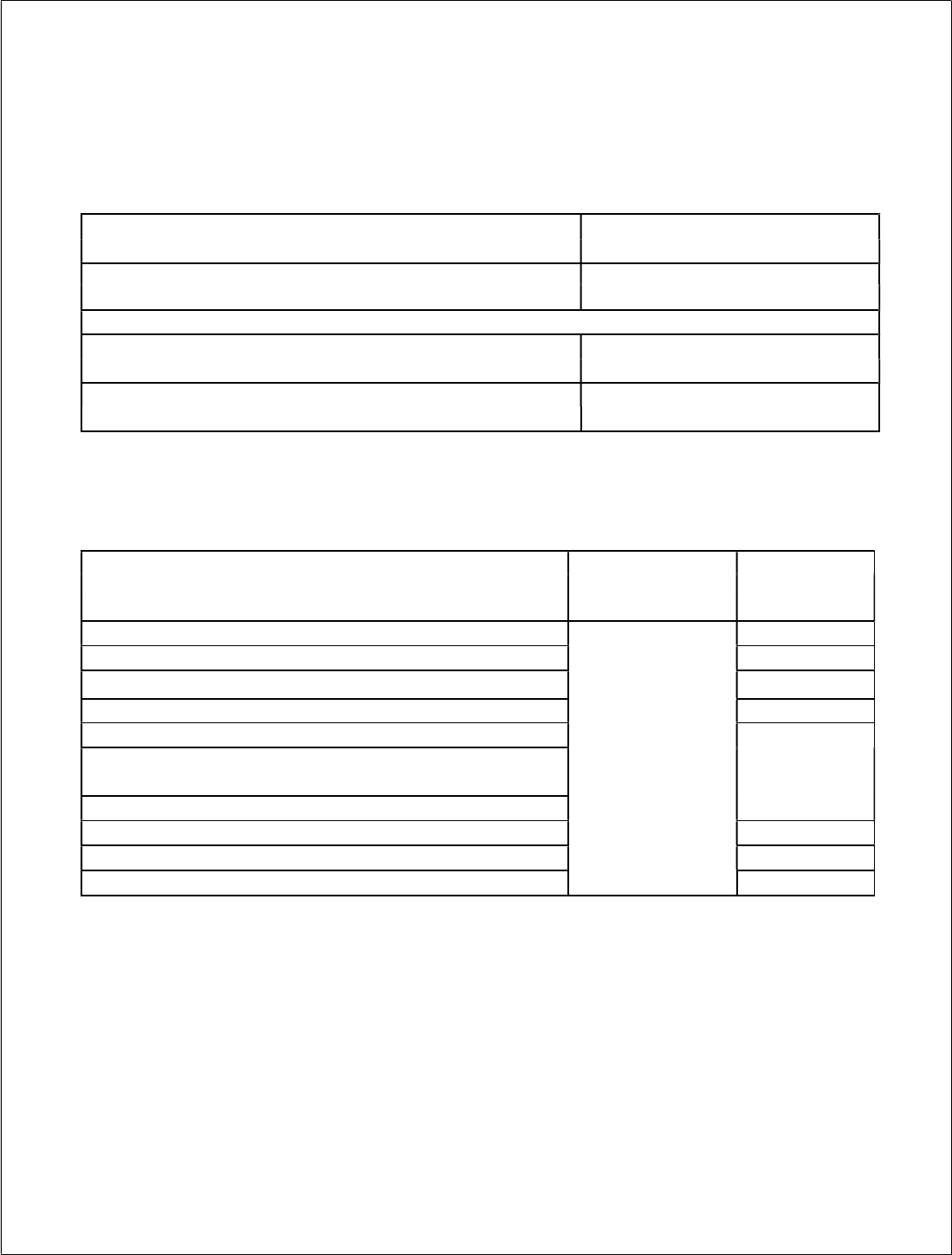

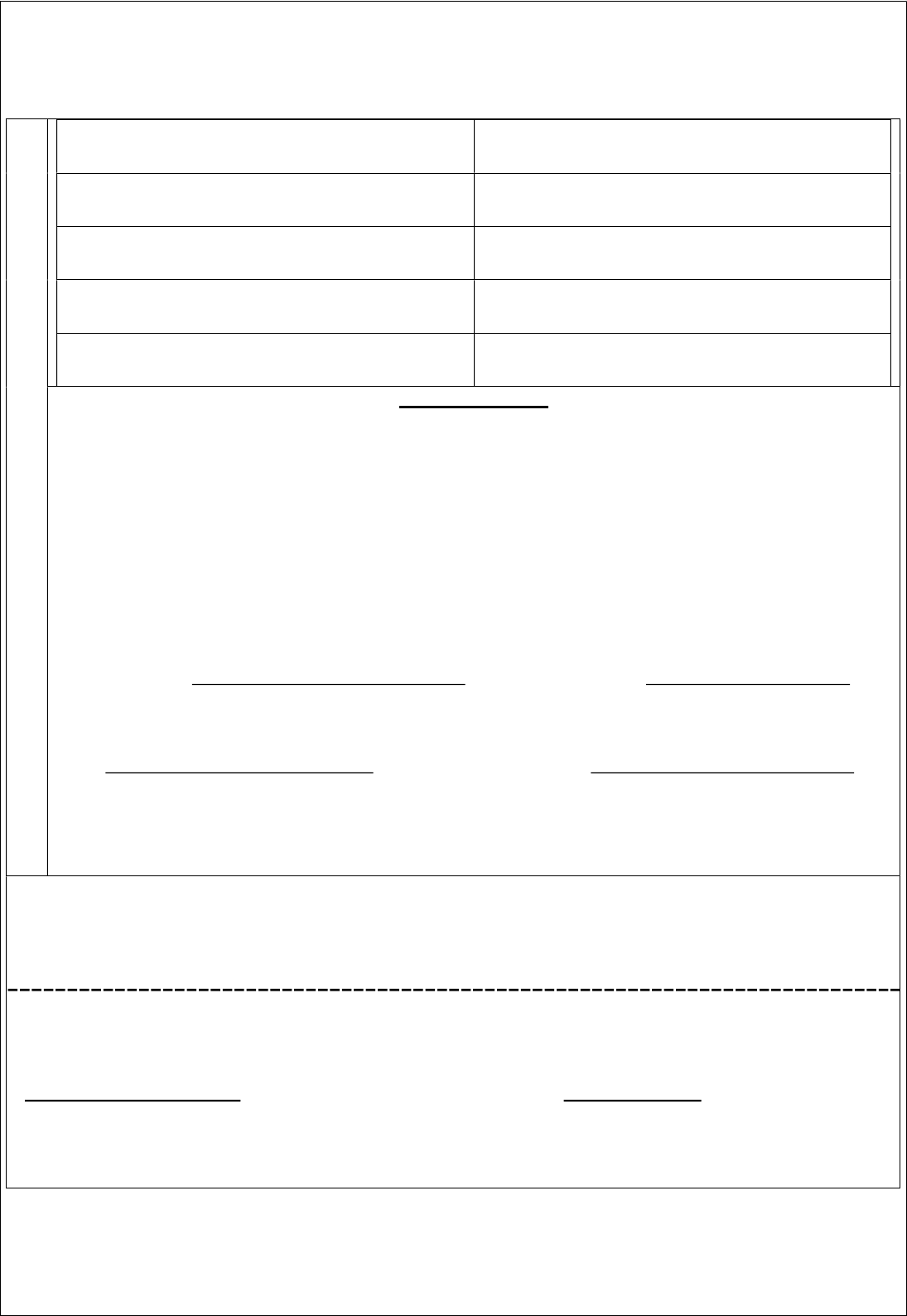

Annexure -1

Unauthorized Transaction due to Bank’s negligence

Time taken to report the fraudulent transaction from Customer’s Maximum Liability

the date of receiving communication from the Bank

(Rs.)

Customer to report as soon as possible

to prevent future

Zero Liability

losses

Unauthorized Transaction due to Customer’s negligence

Time taken to report the fraudulent transaction from

Customer’s Maximum Liability

the date of receiving communication from the Bank

(Rs.)

Customer to

report as soon as possible to prevent future

100% liability till it is reported to

losses

Bank

Maximum Liability of a Customer in case of unauthorized Electronic Transaction where

Responsibility is neither with the Bank nor with the customer but lies elsewhere in the

system & customer has reported unauthorized transaction from transaction date within

working days specified in following table:

Type of Account

Within 3

Within 4 to 7

working days

working days

(Rs.)

(Rs.)

BSBD Accounts

5000

All

other SB accounts

10000

Pre-paid Payment Instruments and Gift Cards

10000

Current/ Cash Credit/ Overdraft Accounts of MSMEs

Zero

10000

Current Accounts/ Cash Credit/ Overdraft Accounts of

Liability

10000

Individuals with annual average balance

(during 365 days

preceding the incidence of fraud)/ limit up to Rs.25 lakh

Credit cards with limit up to Rs.5 lakh

10000

All other Current/ Cash Credit/ Overdraft Accounts

25000

Credit cards with limit above Rs.5 lakh

25000

Any unauthorized electronic banking transaction reported after 7 working days

will be treated as 100% customer liability.

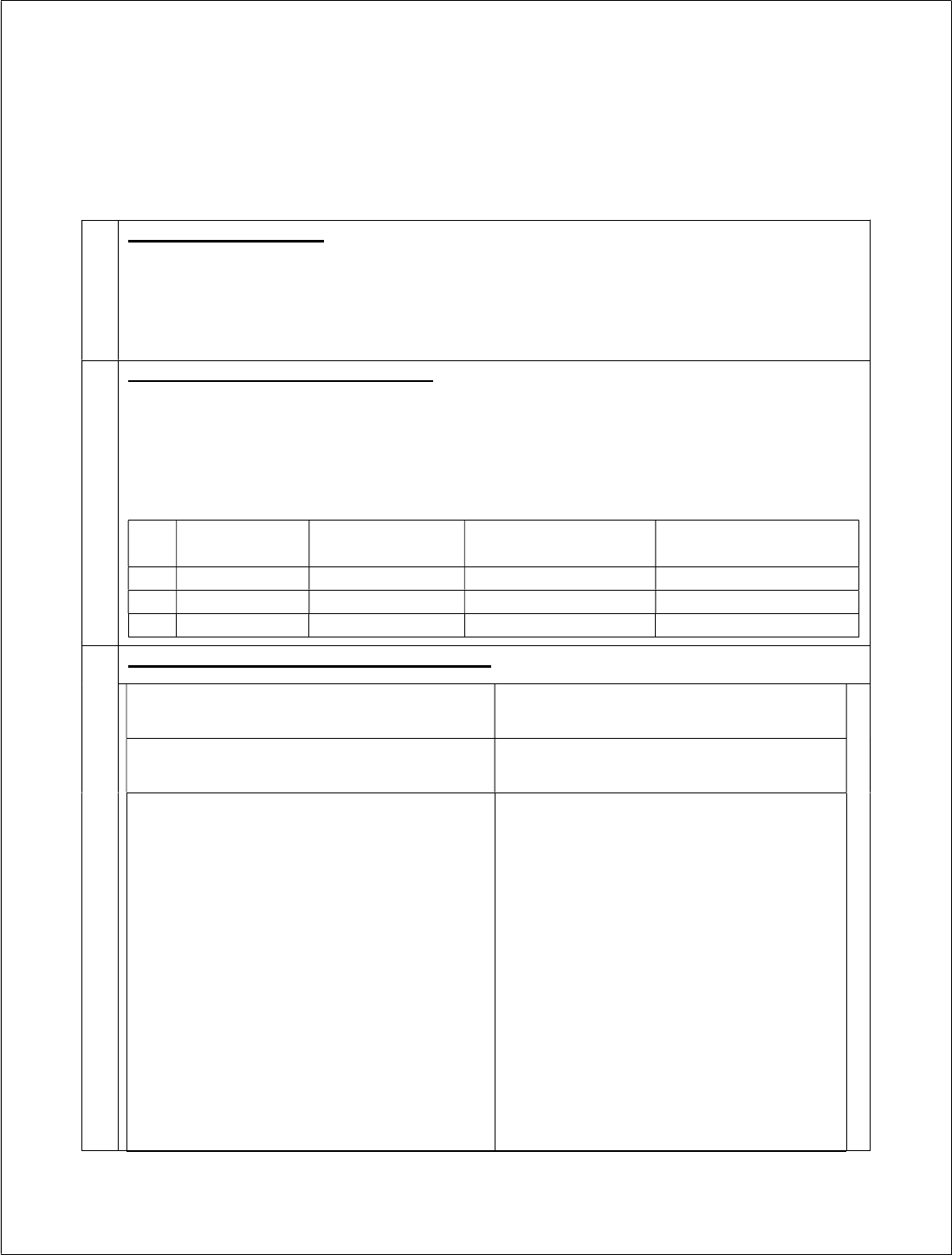

Format for Reporting Unauthorized Electronic Banking Transaction

To: The Branch Manager

Branch:……………………

I

Customer Information

Name of the customer :

Account Number : Customer ID/CIF ID:

Mobile Number : Email ID:

II

Unauthorized Transaction Details :

Channel of transaction - Debit card/ Credit card/ Mobile Banking/Internet Banking/ UPI :

Card Variant* - VISA/ MasterCard/ RUPAY Card Type* - Domestic /

International

Total Amount Involved : Rs.

Details of Unauthorized Transaction (mention all unauthorized transactions):

Sl

No.

Transaction

Date

Transaction

Time

Merchant Name /

ATM Location

Transaction /

Disputed Amount

III

Unauthorized Transaction Questionnaire:

1.

How did you come to know about the

disputed transactions?

SMS

□

Email

□

Account

Statement □ Others (specify) □

2.

Have you received any calls/Email/SMS

before the disputed transaction?

Yes □ No □

3. If Yes,

a)

Phone Number/Email ID from which

the request came:

b)

Have you shared any credentials like

Card details, User ID, Password,

ATM Pin, OTP, UPI Pin, Mpin,

account details to the requester?

c)

Have you forwarded any SMS

received?

d)

Have you clicked on any link

received?

e)

Have you downloaded any app as

instructed in the phone

call/sms/email?

Yes □ No □

If Yes, Specify:

Yes □ No □

Yes

□

No

□

Yes

□

No

□

If Yes, name of the app:

4.

Status of the SIM card during the disputed

transactions:

Active □ Inactive□

5.

Were you in possession of your debit / credit

card

at the time of unauthorized transaction?*

Yes □ No □

6.

Have you surrendered the debit card at the

Branch*

Yes □ No □

7.

Mode of Reporting the Unauthorized transaction

to Bank

Customer Care □ Email □

Visit to Branch □ Others(specify) □

8.

Date & Time of reporting the Unauthorized

transactions to Bank

DECLARATION

I hereby authorize the Bank to close the card, mobile banking and net banking immediately in my account

due to Unauthorized transactions happened. I confirm that the averments made by me within this form are

bona-fide and the information provided is true and accurate to the best of my knowledge and belief. In

case this claim is determined by the Bank to be false or maliciously made, I shall be fully responsible for

the consequences which may include civil/criminal lawsuit being initiated by the Bank. In case if bank

compensates the loss due to the above mentioned disputed transactions either partly or fully, and if I/we

receive any insurance claim subsequently for the same disputed transaction(s), I will inform the matter to

the bank and agree to pay back the compensation paid by the bank.

Customer Name: Signature: _

(Seal is mandatory for business account holders)

Place: Date:

*Mandatory if Unauthorized transaction happened via Debit Card

Note: Other fields are mandatory for all channels

FOR OFFICE USE ONLY

Name & PPC of the officer: Signature & Seal:

ACKNOWLEDGEMENT FROM

BANK

COMPLAINT DETAILS RECEIVED BY

Case Id : Name :

Account number : Designation & PPC:

Received on

:

Signature

: